Running a business is challenging, and sometimes you need expert guidance to navigate complex decisions and strategies. That’s where business advisory services come in.

At Clear View Business Solutions, we often get asked: What are business advisory services? Simply put, they’re professional services that help businesses improve their performance, solve problems, and achieve their goals.

In this post, we’ll explore the world of business advisory services and why they’re essential for your company’s success.

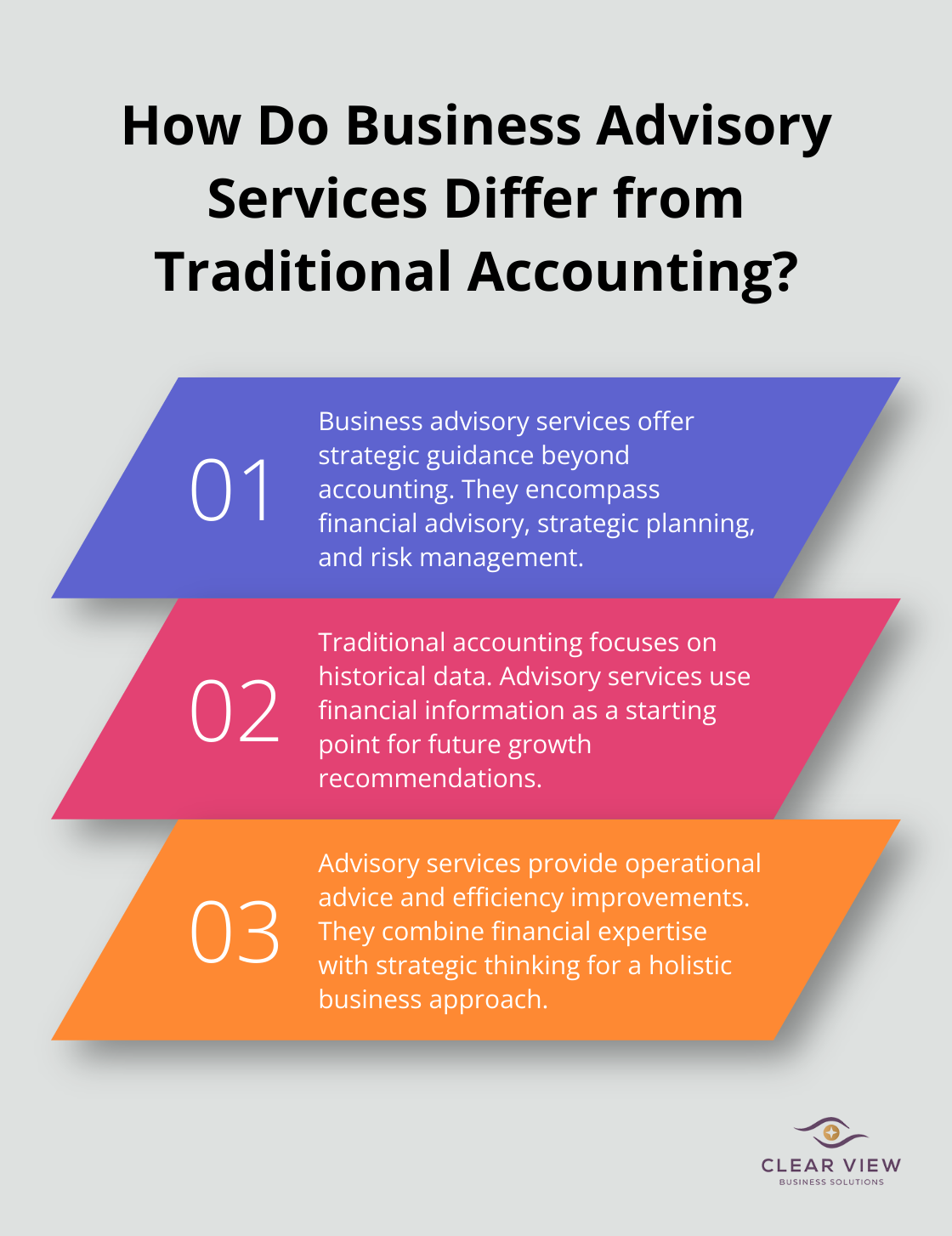

Business advisory services provide professional consultations that offer strategic guidance to companies. These services extend beyond traditional accounting, presenting a comprehensive approach to business management and growth.

Business advisory services encompass a wide range of areas:

While traditional accounting focuses on historical financial data, business advisory services look forward. They use financial information as a starting point to provide insights and recommendations for future growth.

For instance, instead of just preparing tax returns, advisors help clients with tax planning strategies that can save money in the long run.

Business advisory services also often include operational advice. This might involve analyzing business processes, recommending efficiency improvements, or advising on technology investments.

In essence, business advisory services combine financial expertise with strategic thinking to help businesses not just survive, but thrive in today’s competitive landscape. They provide a comprehensive view of a company’s operations, finances, and future prospects.

This holistic approach allows businesses to make informed decisions, optimize their operations, and position themselves for long-term success.

As we move forward, let’s explore the key benefits that these comprehensive business advisory services can bring to your company.

Business advisory services transform companies by sharpening their strategic focus. Advisors collaborate with businesses to establish realistic goals and create actionable roadmaps. This process typically involves market research to find customers, blending consumer behavior and economic trends to confirm and improve business ideas.

A well-crafted strategic plan acts as a compass for businesses, guiding decisions and resource allocation. Companies with clear strategies often outperform their competitors, as they can adapt more quickly to market changes and capitalize on emerging opportunities.

Financial analysis and forecasting form the backbone of effective business advisory services. Advisors employ advanced tools and methodologies to provide deep insights into a company’s financial health and future prospects.

These services help businesses:

Research suggests that for every ten days of business closure during the COVID-19 shutdown, the probability of the business having income loss increased by 3%. This statistic underscores the importance of solid financial planning and analysis.

In today’s complex regulatory landscape, staying compliant presents a significant challenge for businesses. Business advisors play a vital role in risk management and compliance support. They keep clients updated on changing regulations and help implement systems to ensure ongoing compliance.

Effective compliance management not only helps avoid costly penalties but also enhances a company’s reputation and trustworthiness in the market. This proactive approach to compliance can give businesses a competitive edge, especially in highly regulated industries.

Business advisory services drive performance improvement and accelerate growth. Advisors bring a wealth of experience and best practices from various industries, which they apply to each client’s specific situation.

This growth often stems from:

By leveraging the expertise of business advisors, companies can unlock their full potential and achieve sustainable growth in competitive markets.

As we explore the benefits of business advisory services, it becomes clear that choosing the right advisor is critical. In the next section, we’ll discuss how to select a business advisory service that aligns with your company’s unique needs and goals.

Before you start your search, take a step back and assess your business. What are your current challenges? Do you struggle with cash flow management, or do you need help with strategic planning? Perhaps you want to expand into new markets or improve your operational efficiency. Pinpoint your specific needs to find an advisor with the right expertise.

For example, if you’re a startup in Tucson looking to optimize your tax strategy, you’ll want an advisor with experience in both startup operations and local tax laws. Clear View Business Solutions specializes in tax planning for startups, ensuring compliance while maximizing tax benefits.

While general business knowledge is valuable, industry-specific expertise can make a significant difference. An advisor who understands the nuances of your industry can provide more targeted advice and anticipate sector-specific challenges.

Research has found that financial advice has a positive impact on SME performance, particularly for small businesses with 5-49 employees.

When you assess potential advisors, look beyond their qualifications. While certifications and degrees matter, they don’t tell the whole story. Ask for case studies or client testimonials that demonstrate their ability to deliver results.

The American Institute of Certified Public Accountants recommends asking potential advisors about their experience with businesses similar to yours in size and industry. This can give you a clearer picture of their ability to handle your specific challenges.

As your business grows, your advisory needs may change. Look for a firm that offers a comprehensive range of services. This allows for continuity in your advisory relationship and ensures that your advisor can support you through various stages of growth.

Full-service HR consulting firms offer benefits such as access to a team of experts, comprehensive HR solutions, and scalable services.

For instance, Clear View Business Solutions offers a full spectrum of services (from ITIN setup to IRS representation), allowing businesses to have a single point of contact for various financial needs.

The best advisor in the world won’t be effective if their communication style doesn’t mesh with yours. During initial consultations, pay attention to how well they explain complex concepts and whether they take the time to understand your business thoroughly.

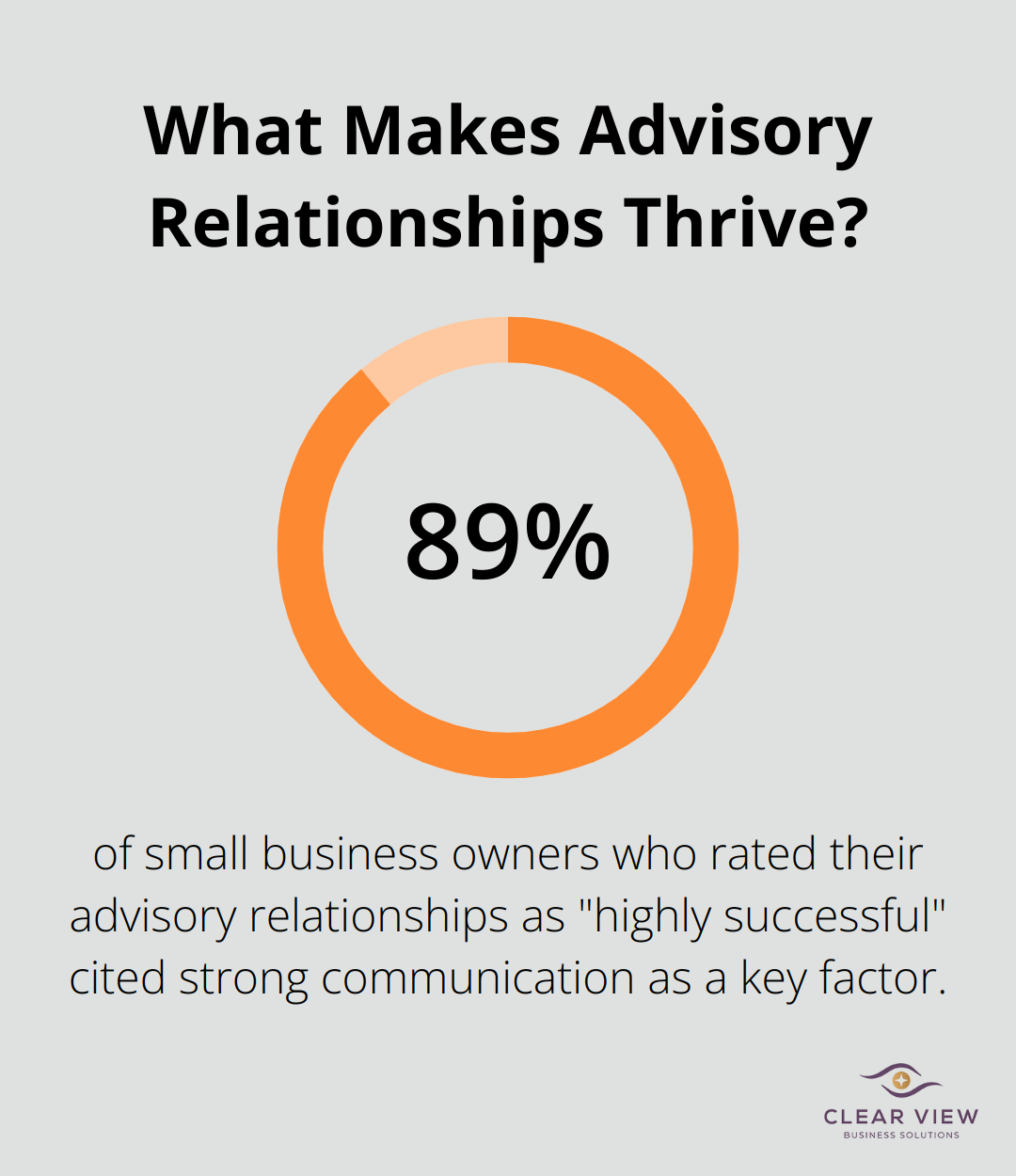

A survey by the Small Business Administration found that 89% of small business owners who rated their advisory relationships as “highly successful” cited strong communication as a key factor.

Choosing a business advisor is not just about finding someone with the right skills; it’s about finding a trusted advisor who can help guide your business to success. Take your time, do your research, and don’t hesitate to ask tough questions. The right advisor can become a valuable asset in navigating the complex world of business and finance.

Business advisory services transform companies by providing strategic guidance, financial optimization, and operational improvements. These services propel businesses forward, offering invaluable insights and strategies to navigate complex challenges and seize new opportunities. Small businesses and startups benefit greatly from the long-term value of business advisory services, which provide a roadmap for growth and support informed decision-making.

Clear View Business Solutions understands the unique challenges faced by individuals and small businesses in Tucson. We offer a range of services, including financial advisory, tax planning, accounting, and bookkeeping, designed to meet specific needs. Our team takes pride in our personalized approach, ensuring each client receives the attention and expertise they deserve.

What are business advisory services? They are not just about solving immediate problems, but about building a strong foundation for long-term success. Choosing the right advisor means investing in your business’s future and setting the stage for sustainable growth and financial stability. Clear View Business Solutions stands ready to guide you on this journey to success.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.