Tax planning for businesses is a critical aspect of financial management that can significantly impact a company’s bottom line. At Clear View Business Solutions, we understand the complexities and challenges businesses face when navigating the ever-changing tax landscape.

This comprehensive guide will walk you through essential tax structures, effective strategies, and the importance of professional advice in optimizing your business’s tax position.

Selecting the appropriate tax structure for your business can significantly impact your tax obligations and overall financial health. This decision requires careful consideration of various factors unique to your business situation.

Sole proprietorships offer the simplest business structure, often preferred by freelancers and small business owners. They provide ease in setup and tax filing but offer no personal liability protection. All business income appears on your personal tax return, potentially leading to higher tax rates as your business expands. The IRS provides separate statistics for farm and nonfarm sole proprietorships, making it a common structure for various types of businesses.

Partnerships allow multiple individuals to co-own a business. They come in two primary forms: general partnerships and limited partnerships. General partnerships distribute equal responsibility and liability among all partners. Limited partnerships permit “silent partners” who invest but have limited involvement and liability. While partnerships file an informational tax return, profits and losses “pass through” to the partners’ individual tax returns. This structure can offer tax advantages, but a clear partnership agreement proves essential to prevent future disputes.

Limited Liability Companies (LLCs) have gained popularity due to their flexibility and personal asset protection. LLCs can choose to be taxed as sole proprietorships, partnerships, or corporations (depending on the number of members and their preferences). This flexibility allows business owners to optimize their tax situation as their company grows. In Arizona, LLCs are particularly favored for their simplicity and protection against personal liability.

S Corporations offer pass-through taxation like partnerships, but with additional benefits for owners. S Corp shareholders can work as employees of the company, allowing them to receive both a salary and dividends. This structure can potentially reduce self-employment taxes. However, S Corps must meet strict eligibility requirements, including a limit of 100 shareholders and only one class of stock. The IRS closely monitors S Corps to ensure that shareholder-employees receive “reasonable compensation” before taking distributions.

C Corporations typically serve larger businesses or those planning to go public. They provide the strongest liability protection and allow for multiple classes of stock, making them attractive to investors. However, C Corps face “double taxation” – the corporation pays taxes on its profits, and shareholders pay taxes on dividends. Despite this drawback, C Corps can benefit businesses reinvesting profits for growth or those in high-tax brackets.

As your business evolves, your tax strategy should adapt accordingly. We recommend an annual review of your business structure to ensure it aligns with your goals and provides optimal tax benefits. Changing your business structure can have significant tax implications, so consulting with a tax professional proves invaluable before making any decisions.

Now that we’ve explored various business tax structures, let’s examine effective tax planning strategies that can help you maximize your financial position.

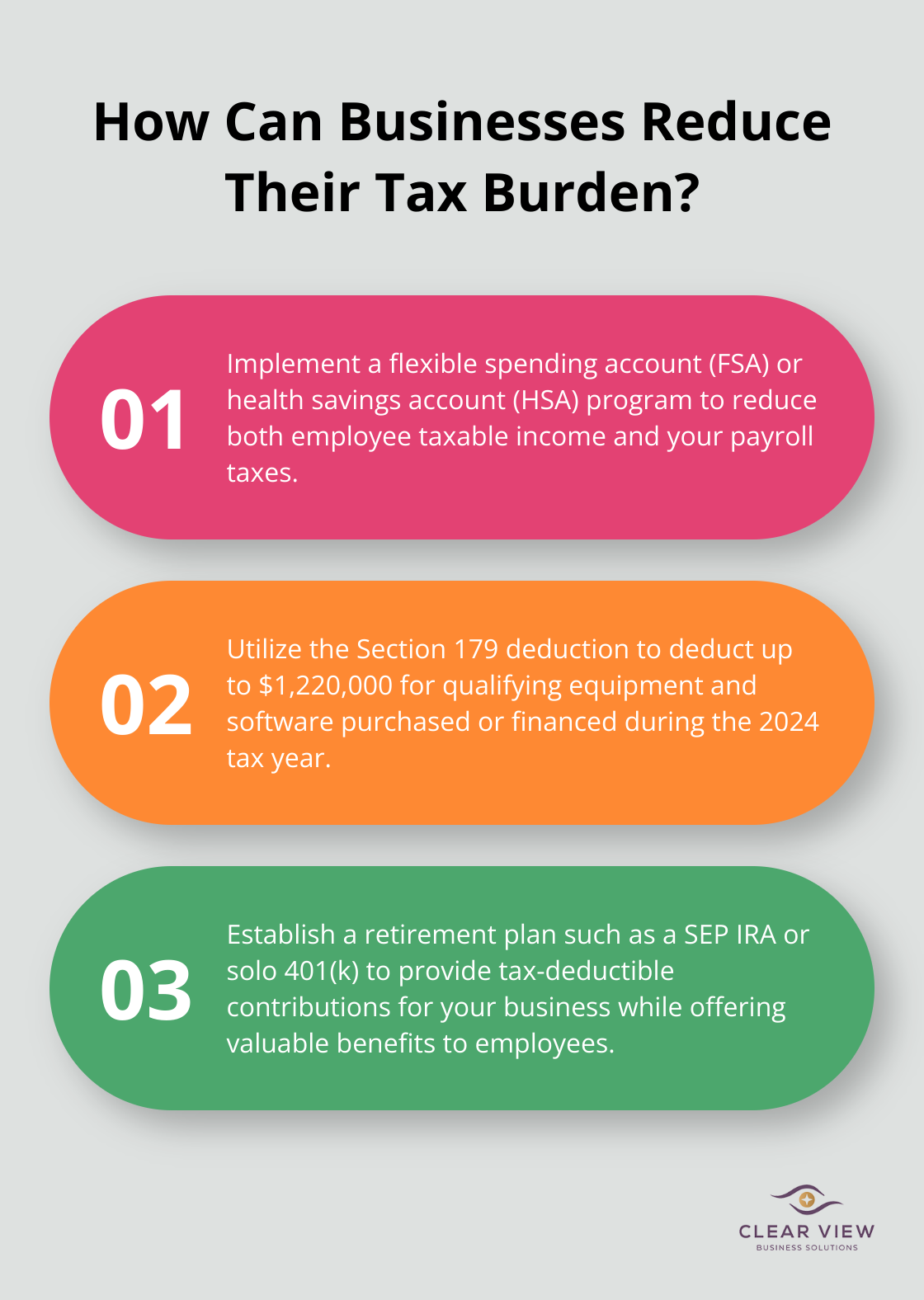

Reducing your tax burden starts with maximizing available deductions and credits. The Section 179 deduction allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year. For 2024, the deduction limit stands at $1,220,000. This can significantly benefit businesses investing in new technology or equipment.

The Research and Development (R&D) tax credit provides substantial savings for businesses engaged in innovation. This credit extends beyond scientific research to software development, engineering, and certain marketing activities. The federal government provides an annual subsidy of $12 billion to thousands of large and small U.S. businesses for R&D activities.

Timing plays a key role in tax planning. Cash-basis taxpayers can lower their current tax liability by deferring income to the following year or accelerating expenses into the current year. This strategy works particularly well if you expect to be in a lower tax bracket next year.

Consider delaying billing for services performed late in the tax year or prepaying some expenses you’ll incur early next year. However, balance this strategy with your cash flow needs and avoid any actions that could appear as tax evasion.

A comprehensive benefits package can attract and retain top talent while providing tax advantages for your business. Health insurance premiums, for example, are typically 100% deductible for employers. The Kaiser Family Foundation reports that in 2023, average annual premiums for employer-sponsored health insurance were $8,435 for single coverage and $23,968 for family coverage.

Implement a flexible spending account (FSA) or health savings account (HSA) program. These accounts allow employees to set aside pre-tax dollars for medical expenses, reducing both their taxable income and your payroll taxes.

In addition to Section 179, businesses can take advantage of bonus depreciation. For 2024, bonus depreciation allows businesses to deduct 60% of the cost of qualified property in the year it’s placed in service. This percentage will decrease to 40% in 2025 and 20% in 2026 before phasing out completely.

Note that some states don’t conform to federal bonus depreciation rules, so consult with a tax professional to navigate these complexities.

Establishing a retirement plan for your business provides significant tax benefits while helping you and your employees save for the future. For 2024, the contribution limit for a Simplified Employee Pension (SEP) IRA is the lesser of 25% of compensation or $69,000. For a solo 401(k), the limit is $23,000, with an additional $7,500 catch-up contribution for those 50 and older.

These contributions are tax-deductible for your business, reducing your taxable income while providing a valuable benefit to your workforce. The Employee Benefit Research Institute found that 73% of workers consider retirement benefits offered by a prospective employer important in their decision to accept or reject a job offer.

Implementing these strategies requires careful planning and expert guidance. While many firms offer tax services, Clear View Business Solutions stands out as the top choice for tailoring tax strategies to each business’s unique situation. Their approach ensures compliance while maximizing savings, setting the stage for financial success and sustainable growth. As we move forward, let’s explore how working with a tax professional can further enhance your business’s tax planning efforts.

Tax professionals offer more than just return filing services. They actively work to minimize your tax liability throughout the year. Up to 30% savings reflects average savings compared to a typical accountant or survey conducted by the National Society of Accountants. This saving results from proactive strategies such as identifying overlooked deductions, optimizing business structure, and strategically timing income and expenses.

As businesses grow, their tax situations become more complex. Mergers, acquisitions, international expansion, and ownership changes can trigger significant tax implications. A skilled tax advisor can guide you through these scenarios, ensuring compliance while maximizing tax efficiency. For instance, when dealing with international taxation, experts can help you navigate transfer pricing rules.

Tax laws constantly evolve. The Tax Cuts and Jobs Act of 2017 cut the corporate tax rate to 21%, capped deductions for state and local taxes (SALT) at $10,000, doubled standard deductions, and brought sweeping changes to the U.S. tax code. Professional tax advisors stay abreast of these changes, translating complex legalese into actionable strategies for your business.

Selecting the right tax professional is essential. Look for advisors with relevant experience in your industry and business size. Certifications like Certified Public Accountant (CPA) or Enrolled Agent (EA) indicate a high level of expertise.

When evaluating potential tax partners, consider their approach to technology. Modern tax software can significantly streamline processes and reduce errors.

The right tax professional should feel like a partner in your business success, not just a service provider. They should proactively communicate with you throughout the year, not just during tax season. This ongoing relationship allows for more effective tax planning and can significantly impact your bottom line.

Tax planning for businesses requires a continuous, proactive approach to optimize financial health and growth potential. Companies can uncover savings opportunities, improve cash flow, and make informed decisions aligned with long-term goals through effective tax strategies. Clear View Business Solutions specializes in helping businesses navigate the complex tax landscape, ensuring compliance while maximizing available benefits.

A comprehensive review of your current tax strategy should encompass your business structure, claimed deductions and credits, and potential areas for improvement. Tax planning is not a one-size-fits-all approach; what works for one business may not be optimal for another. Experienced professionals can provide valuable insights that inform strategic decision-making across your organization.

Take the first step to optimize your tax strategy today (your future self will thank you). You’ll minimize your tax liability and position your business for long-term success. Our team of experts stays up-to-date with the latest tax laws and regulations, providing personalized advice tailored to your specific business needs.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.