As we approach 2025, significant tax changes are on the horizon. These shifts will impact individuals and businesses alike, making proactive tax planning more important than ever.

At Clear View Business Solutions, we’ve compiled essential tax planning tips for 2025 to help you navigate these changes effectively. Our guide covers key updates in legislation, strategies for individuals, and crucial considerations for small businesses.

The tax landscape will shift significantly in 2025, with several key changes affecting both individuals and businesses. These updates will reshape tax planning strategies and financial decisions for many taxpayers.

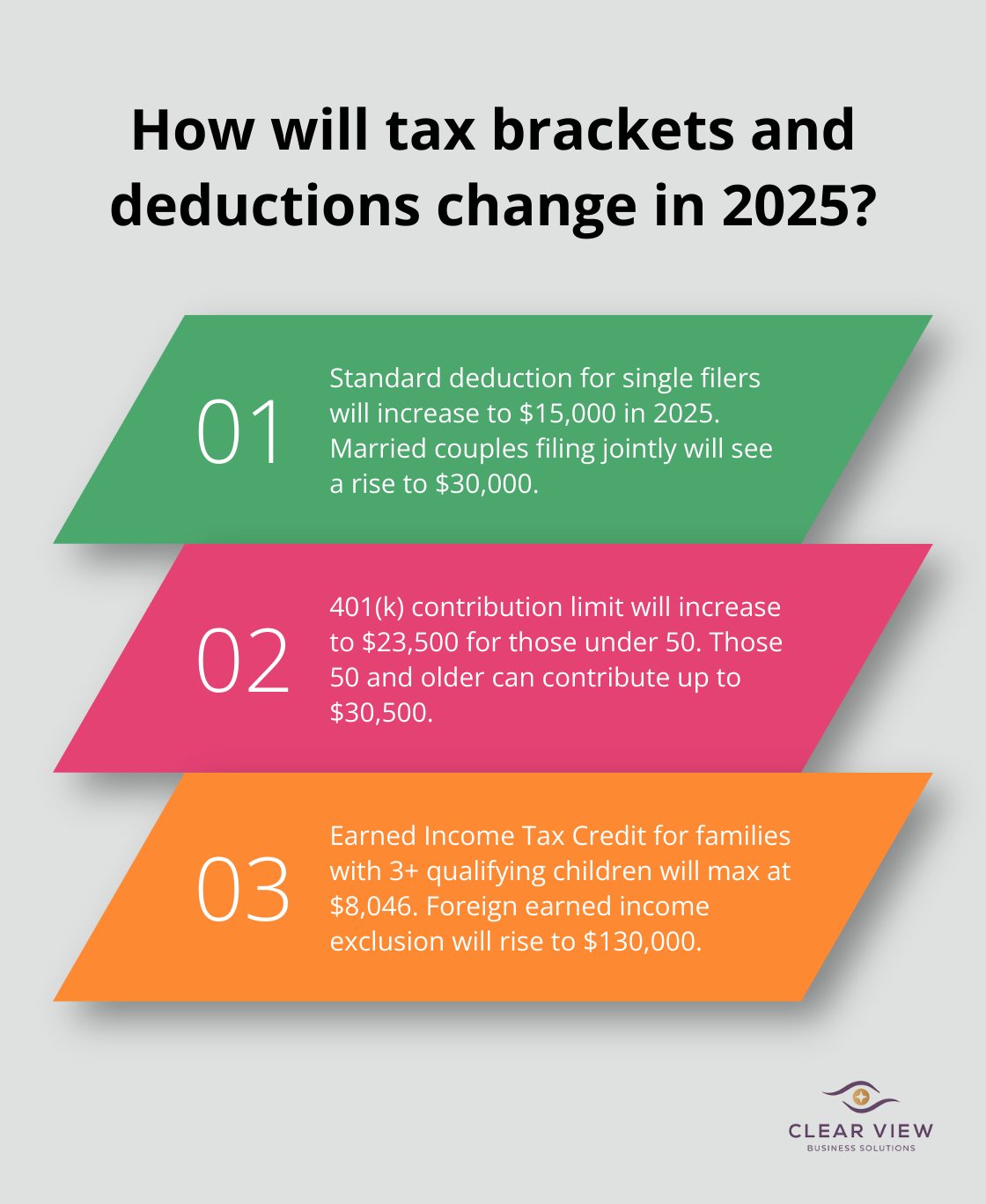

In 2025, tax brackets and standard deductions will adjust. The standard deduction for single filers will increase to $15,000, while married couples filing jointly will see a rise to $30,000. These changes aim to provide relief to taxpayers, but they may impact overall tax liability in unexpected ways.

Retirement savers will benefit from increased contribution limits for various accounts. The IRS has announced that the 401(k) contribution limit will rise to $23,500 for those under 50, and $30,500 for those 50 and older. IRA contribution limits will also increase modestly. These changes present an opportunity to boost retirement savings while potentially lowering taxable income.

Several new tax credits and deductions will emerge in 2025. The Earned Income Tax Credit (EITC) for families with three or more qualifying children will increase to a maximum of $8,046, providing significant relief for low to moderate-income families.

The foreign earned income exclusion will rise to $130,000, benefiting U.S. citizens working abroad. For those considering adoption, the maximum adoption credit for a child with special needs will increase to $17,280.

These changes come with complexities (particularly in the interaction between various credits and deductions). The interplay of different tax provisions can significantly impact your overall tax picture. Working with experienced professionals will help you navigate these changes effectively and optimize your tax strategy.

As 2025 approaches, it’s essential to start planning now. These tax changes could substantially impact your financial strategy, whether you’re an individual taxpayer or a small business owner. Proactive adjustments to your approach could potentially save thousands of dollars in taxes.

The next chapter will explore specific strategies for individuals to optimize their tax savings in light of these upcoming changes. We’ll examine how to maximize retirement contributions, leverage Health Savings Accounts (HSAs), and implement strategic charitable giving techniques.

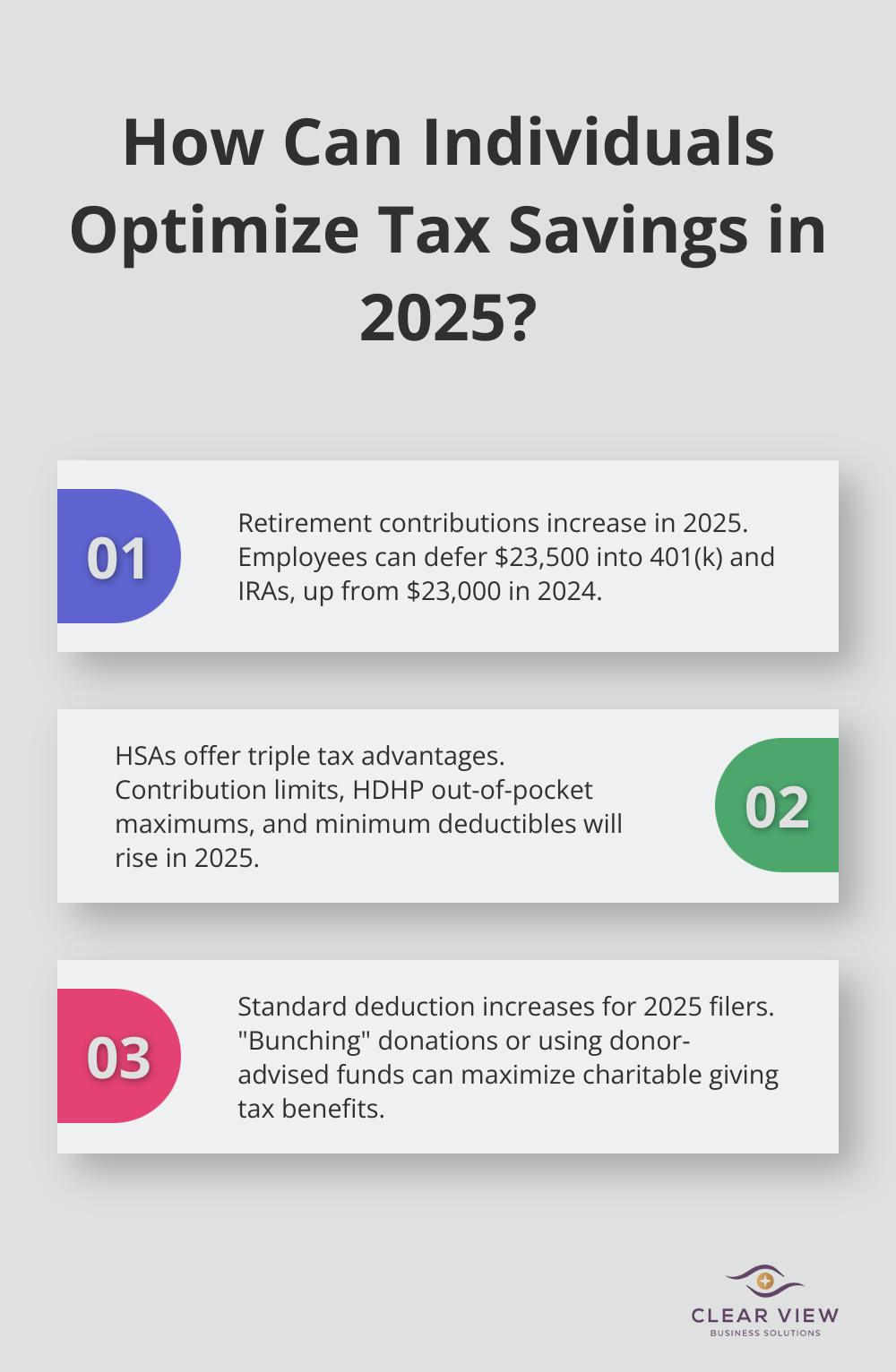

One of the most effective ways to reduce taxable income is to maximize retirement contributions. For tax year 2025, employees can defer $23,500 into their 401(k) and IRAs, a modest increase from the $23,000 contribution limit in 2024. This presents a significant opportunity to boost retirement savings while lowering tax bills.

For those with access to both a 401(k) and an IRA, it’s advantageous to max out both accounts. Full utilization of these retirement vehicles could potentially reduce taxable income by tens of thousands of dollars.

It’s important to note that Roth accounts, while not providing immediate tax benefits, offer tax-free growth and withdrawals in retirement. Depending on current tax brackets and future expectations, a mix of traditional and Roth contributions might be optimal.

Health Savings Accounts (HSAs) are often overlooked but can be a powerful tool for tax savings. If enrolled in a high-deductible health plan, individuals are eligible to contribute to an HSA. These accounts offer a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

In 2025, tax-deductible/tax-free HSA contribution limits, HDHP in-network out-of-pocket maximums and HDHP minimum annual deductibles will rise from 2024 levels. For those 55 and older, an additional catch-up contribution is allowed.

It’s beneficial to max out HSA contributions each year. If able to pay for current medical expenses out of pocket, HSA funds can grow tax-free for future use (potentially in retirement).

Charitable giving can effectively reduce tax burdens while supporting important causes. In 2025, the standard deduction will increase for single filers and married couples filing jointly. This means fewer people will itemize deductions, potentially reducing the tax benefits of charitable giving.

However, strategies exist to maximize the tax benefits of charitable contributions. One effective approach is “bunching” donations. Instead of giving a set amount each year, consider doubling or tripling the usual donation in a single year to exceed the standard deduction threshold.

Another powerful tool is the donor-advised fund (DAF). With a DAF, individuals can make a large contribution in one year, take the tax deduction immediately, and then distribute the funds to charities over time. This allows exceeding the standard deduction threshold in the year of contribution while maintaining a steady stream of support for chosen charities.

Tax-efficient investing strategies can significantly impact overall tax liability. Consider holding tax-efficient investments (such as index funds or ETFs) in taxable accounts, while keeping less tax-efficient investments (like high-yield bonds) in tax-advantaged accounts.

Additionally, tax-loss harvesting can be an effective strategy. This involves selling investments at a loss to offset capital gains, potentially reducing overall tax liability.

As we move into the next section, it’s important to recognize that tax planning for small businesses involves a unique set of considerations and strategies. From entity structure to depreciation methods, business owners have several tools at their disposal to optimize their tax position in 2025.

The structure of your business impacts your tax obligations significantly. Each entity type (sole proprietorship, partnership, LLC, S corporation, or C corporation) has distinct tax implications. S corporations can provide tax advantages through income splitting between salary and distributions, which potentially reduces self-employment taxes.

Small businesses should reassess their entity structure annually. As a business grows or changes, a different structure might offer better tax benefits. For example, a sole proprietorship might benefit from transitioning to an S corporation once profits reach a certain threshold.

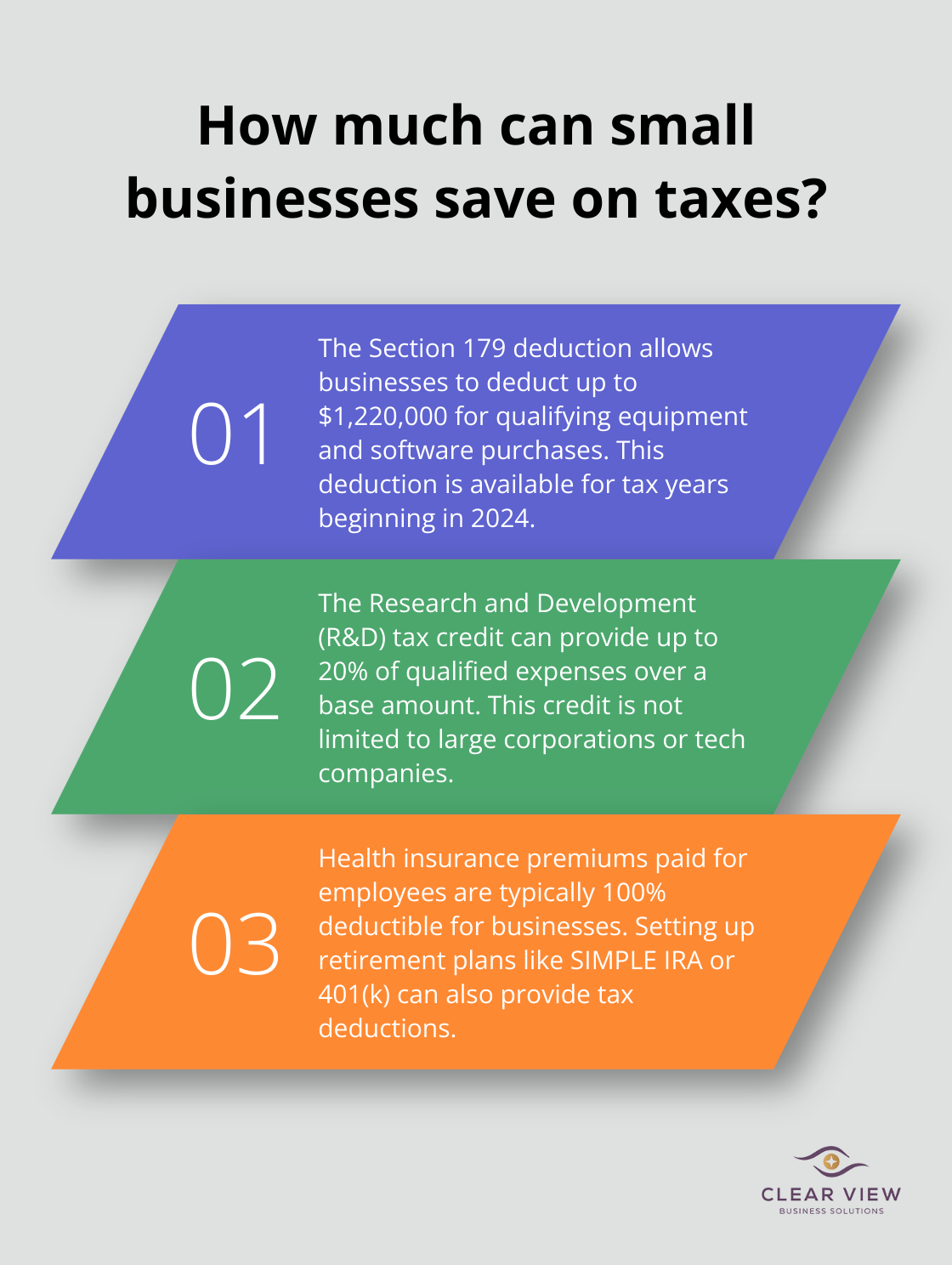

Small businesses have numerous deductions and credits available, but many go unclaimed due to lack of awareness. The Section 179 deduction allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year. For tax years beginning in 2024, the maximum section 179 expense deduction is $1,220,000.

Another often-overlooked opportunity is the Research and Development (R&D) tax credit. This credit isn’t just for large corporations or tech companies. Many small businesses engaged in developing new products, processes, or software may qualify. The credit can be up to 20% of qualified expenses over a base amount.

Employee benefits can serve dual purposes: attracting top talent and providing tax advantages for your business. Health insurance premiums paid for employees are typically 100% deductible. Additionally, setting up a retirement plan (like a SIMPLE IRA or a 401(k)) can provide tax deductions for the business while helping employees save for their future.

A less common but potentially valuable option is the qualified small business stock (QSBS) exclusion. This powerful tax incentive allows eligible taxpayers to exclude from federal income tax the gain on the sale of their stock.

Tax laws evolve constantly, and 2025 will bring significant changes. The Tax Cuts and Jobs Act provisions will expire at the end of 2025, which could lead to higher tax rates for many businesses. It’s important to stay informed about these changes and plan accordingly.

One strategy to consider is to accelerate income into 2025 if tax rates are expected to increase in 2026. Conversely, if possible, you might want to defer deductions to 2026 when they could potentially offset income taxed at a higher rate.

The right technology can streamline your tax processes and help identify savings opportunities. Cloud-based accounting software can provide real-time financial data, making it easier to make informed tax decisions throughout the year rather than scrambling at tax time.

Robust accounting systems that track expenses accurately and categorize them properly for tax purposes not only ensure you claim all eligible deductions but also provide a clear audit trail if needed.

The tax landscape will change significantly in 2025. These changes will affect individuals and businesses, creating opportunities and challenges for strategic tax planning. We at Clear View Business Solutions understand the complexities of these tax changes and their potential impact on your financial well-being.

Our team of experts provides comprehensive tax planning tips for 2025. We offer personalized guidance to help you navigate these changes effectively, ensuring you’re well-prepared for the new tax environment. Our tax planning services simplify complex financial matters and empower you to make informed decisions.

Clear View Business Solutions can help you face the changing tax landscape with confidence. We provide expert guidance to help you navigate every twist and turn. Contact us today to ensure your tax strategy is proactive and tailored to your specific needs.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.