Tax season can be stressful, but it doesn’t have to be. Strategic tax planning is the key to maximizing your returns and minimizing your tax burden.

At Clear View Business Solutions, we believe that proactive tax management is essential for financial success. This blog post will guide you through effective strategies to optimize your tax situation and help you keep more of your hard-earned money.

Strategic tax planning transcends the annual tax filing ritual. It embodies a proactive approach to financial management, focusing on informed decision-making throughout the year to minimize tax liability and maximize financial benefits.

Tax planning and tax evasion are not synonymous. Tax planning utilizes legal methods to reduce tax burden, while tax evasion illegally avoids tax payment. The IRS actively encourages taxpayers to use available deductions and credits.

Proactive tax planning yields substantial benefits for individuals. This approach puts more money in your pocket and provides greater financial flexibility.

For businesses, effective tax planning extends beyond mere cost savings. It improves cash flow, a critical factor for small business success. Strategic tax planning frees up cash for investments, expansion, or financial contingencies. Setting up a separate account for tax is just one example of a step that can be put into place to help prepare you for tax time and manage your cash flow.

Strategic tax planning requires continuous attention. This ongoing approach not only saves money but also provides peace of mind. It prepares you for tax season, reduces the likelihood of costly mistakes, and increases your chances of minimizing your tax burden.

As we move forward, let’s explore the key strategies that can help you maximize your tax returns and optimize your financial position.

One of the most effective tax planning strategies involves the timing of income and expenses. Self-employed individuals or those with control over income receipt should consider deferring income to the next tax year if they expect to be in a lower tax bracket. Conversely, accelerating income into the current year might be beneficial if a higher tax bracket is anticipated next year.

For expenses, the opposite approach applies. Paying deductible expenses before year-end can reduce taxable income for those in a higher tax bracket this year. This strategy might include making charitable donations, paying property taxes, or purchasing business equipment.

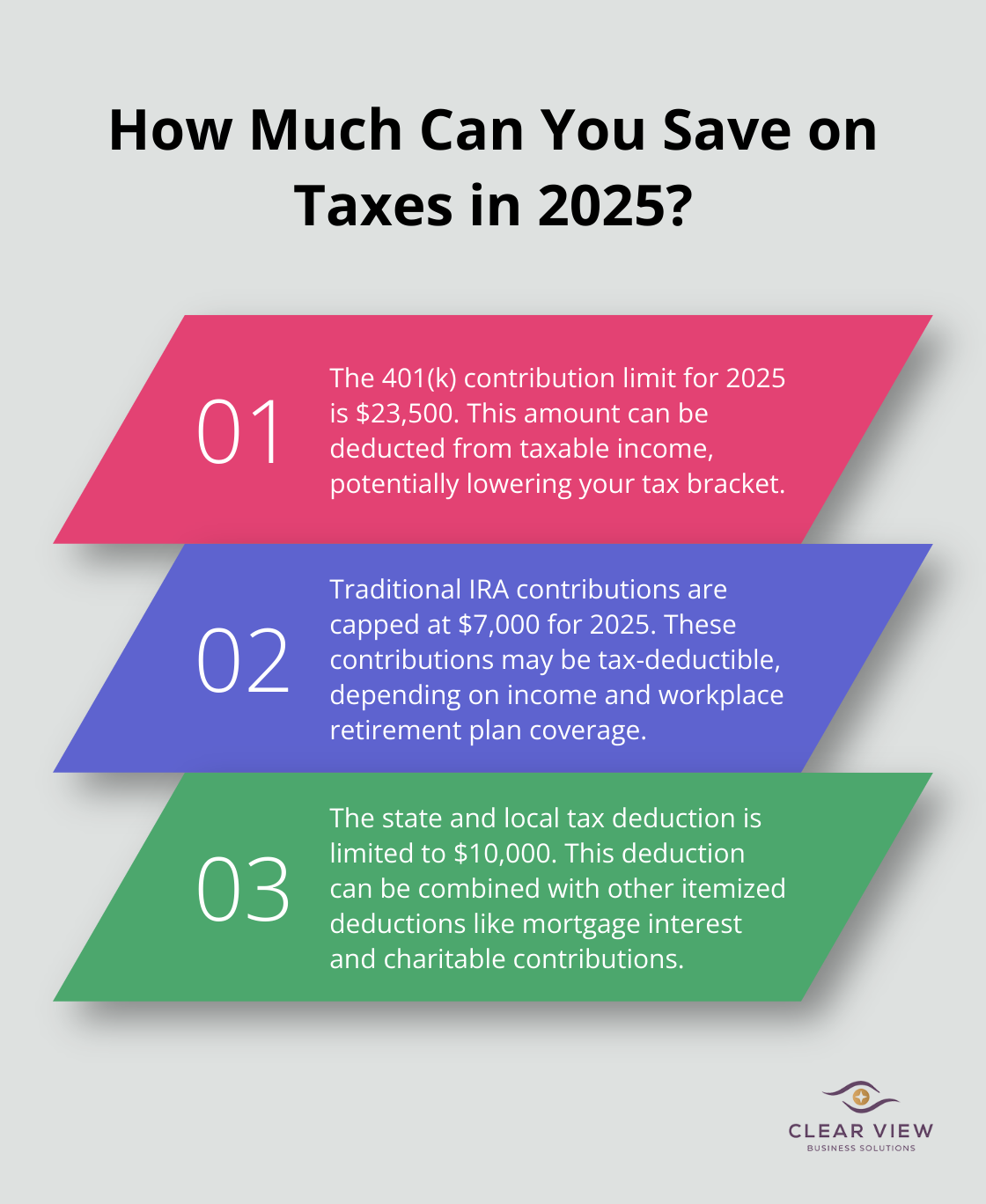

Maximizing contributions to tax-advantaged accounts reduces taxable income and builds future wealth. For 2025, individuals can contribute up to $23,500 to a 401(k). These pre-tax dollar contributions decrease taxable income for the year.

Individual Retirement Accounts (IRAs) offer additional tax savings opportunities. In 2025, individuals can contribute up to $7,000 to a traditional IRA. These contributions may be tax-deductible (depending on income and workplace retirement plan coverage).

Health Savings Accounts (HSAs) provide triple tax benefits: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

Taking full advantage of available deductions and credits can significantly reduce tax bills. Common deductions include mortgage interest, state and local taxes (up to $10,000), and charitable contributions. Self-employed individuals may deduct home office expenses, health insurance premiums, and half of their self-employment tax.

Tax credits (even more valuable than deductions) reduce tax bills dollar-for-dollar. Popular credits include the Child Tax Credit, the American Opportunity Tax Credit for education expenses, and the Retirement Savings Contributions Credit for low- and moderate-income taxpayers.

The Alternative Minimum Tax (AMT) prevents wealthy taxpayers from using loopholes to avoid paying taxes. Due to inflation adjustments, more taxpayers may be affected by the AMT.

To avoid AMT surprises, taxpayers should project their tax liability under both the regular tax system and the AMT. This approach allows for informed decisions about income and deduction timing. For example, exercising incentive stock options in years when not subject to the AMT might be a wise choice.

Navigating these complex tax strategies can be challenging. Working with a professional tax advisor (such as those at Clear View Business Solutions) can help develop a personalized tax plan that maximizes returns while ensuring compliance with all applicable tax laws. Tax professionals stay up-to-date with the latest tax code changes and use sophisticated tax planning software to model different scenarios, identifying the most advantageous strategies for unique situations.

As we explore the benefits of working with a tax professional in the next section, you’ll discover how expert guidance can further enhance your tax planning efforts and financial success.

Strategic tax planning requires expertise. A skilled tax professional can transform your financial future. This section explores how to select the right advisor and what to expect from this partnership.

When you search for a tax professional, qualifications matter, but expertise in your specific financial situation is paramount. For example, if you own a small business, you should find an advisor with a strong track record in business taxation.

You can start your search by asking for recommendations from colleagues or industry associations. After creating a shortlist, schedule consultations to assess their communication style and approach. An effective tax advisor explains complex concepts clearly and shows genuine interest in your financial goals.

Don’t hesitate to discuss fees upfront. While cost is a factor, the value of expert advice often exceeds the expense. However, the potential tax savings and peace of mind can be substantial.

Your initial meeting with a tax professional should be thorough. You need to share detailed financial information, including income sources, investments, and major life changes. The advisor will use this information to create a tailored tax strategy.

A competent tax professional will conduct a comprehensive review of your previous tax returns. They might identify missed opportunities for deductions or credits.

Your tax advisor should help you project your future tax liabilities. This foresight allows you to make informed decisions about investments, major purchases, or business expansions. They should provide clear action steps to implement throughout the year (not just at tax time).

To optimize your relationship with your tax professional, maintain open communication throughout the year. Inform them about significant financial changes or decisions. This ongoing dialogue enables them to provide timely advice that can lead to substantial tax savings.

Utilize your advisor’s expertise beyond tax preparation. They can offer valuable insights on financial planning, retirement strategies, and estate planning.

The relationship with your tax professional is a partnership. Your engagement improves outcomes. Ask questions, seek clarification on complex issues, and actively implement their recommendations.

A skilled tax professional helps you navigate the complexities of the tax code with confidence and achieve your long-term financial goals. Clear View Business Solutions offers comprehensive tax services and personalized guidance to help you maximize your returns and secure your financial future.

Strategic tax planning transforms your financial future. It empowers you to control your finances, improve cash flow, and invest more in your future. Professional guidance proves invaluable in navigating the complex world of taxes and maximizing your returns.

Clear View Business Solutions specializes in helping individuals and small businesses in Tucson optimize their tax situations. We offer comprehensive financial advisory, tax services, accounting, and bookkeeping tailored to your unique needs (including ITIN setup and IRS representation). Our expertise ensures you comply with regulations while taking advantage of every available tax benefit.

Partner with Clear View Business Solutions to develop a strategic tax plan that aligns with your goals. We will help you turn tax planning into a powerful tool for your financial success. Our personalized service simplifies complex financial matters and sets you on the path to financial stability and growth.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.