QuickBooks has become the go-to software for small business bookkeeping, but mastering its features can be challenging. At Clear View Business Solutions, we’ve seen how proper QuickBooks usage can transform financial management for our clients.

This guide will walk you through the bookkeeping basics QuickBooks offers, from initial setup to advanced features. We’ll also highlight common pitfalls to avoid, ensuring you make the most of this powerful tool.

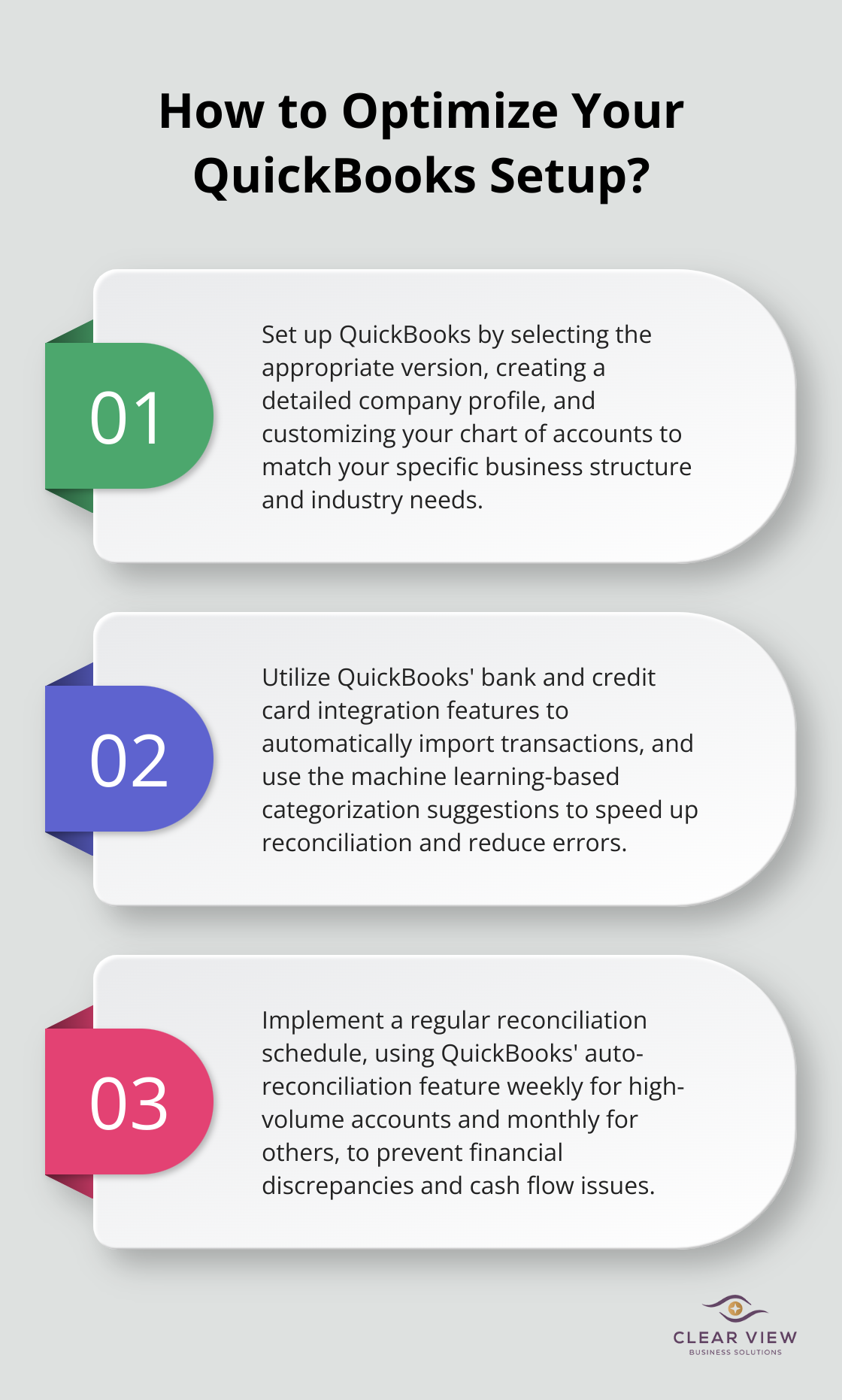

The first step in QuickBooks setup involves choosing the appropriate version. QuickBooks Online Plus and Advanced include inventory tracking, while QuickBooks Desktop’s Enterprise plan offers more industry-specific features. Manufacturing businesses, for instance, often prefer Desktop for its advanced inventory management capabilities.

After version selection, create your company profile. This step extends beyond entering your business name and address. You must input your tax information, fiscal year, and industry type. These details shape how QuickBooks functions for your specific needs.

The chart of accounts forms the backbone of your QuickBooks setup. It lists all accounts you’ll use to categorize financial transactions. While QuickBooks provides industry-specific templates, customization to match your unique business structure proves beneficial. A restaurant might need separate accounts for food and beverage sales, while a consulting firm might focus on different service categories.

A well-structured chart of accounts enhances financial reporting and simplifies tax preparation.

QuickBooks offers numerous customization options. Set up your preferences for invoicing, expense tracking, and reporting. If you bill clients by the hour, enable time tracking features. For inventory management, activate the inventory tracking module.

QuickBooks’ business expense tracking software allows you to start snapping expense receipts and tracking every detail with ease.

The class tracking feature (often overlooked) allows you to categorize transactions by department, location, or product line, providing deeper insights into your business performance.

While initial setup might seem time-consuming, it pays off in the long run. A properly configured QuickBooks account can save hours of work each month and provide valuable insights into your business finances. If you’re unsure about any aspect of the setup process, consider seeking professional help. Clear View Business Solutions specializes in tailoring QuickBooks to meet the unique needs of small businesses in Tucson.

Now that you’ve set up your QuickBooks account, let’s explore the essential features that will help you maintain accurate and efficient bookkeeping practices.

QuickBooks offers a range of powerful features that can streamline your bookkeeping process. Let’s explore how to leverage these tools to maintain accurate financial records and gain valuable insights into your business performance.

QuickBooks excels at recording income and expenses with precision. Enter payments immediately into the system when you receive them. QuickBooks allows you to categorize income sources, helping you understand which products or services are most profitable. For expenses, use the built-in receipt capture feature to snap photos of receipts on the go. This feature uses optical character recognition (OCR) technology to extract key information, reducing manual data entry and potential errors.

Creating and sending invoices becomes easy with QuickBooks. You can customize invoice templates to match your brand and set up recurring invoices for regular clients. QuickBooks also offers automatic payment reminders, which can improve your cash flow.

For bill management, QuickBooks allows you to enter bills as they arrive and schedule payments. This feature helps you avoid late fees and take advantage of early payment discounts. You can also set up vendor rules to automatically categorize recurring bills, saving time and reducing errors.

Regular reconciliation is essential for accurate bookkeeping. QuickBooks can connect directly to your bank and credit card accounts, automatically importing transactions. This integration reduces manual data entry and the risk of errors. The software also uses machine learning to suggest transaction categories based on your previous entries, making the reconciliation process faster and more accurate over time.

QuickBooks’ reporting capabilities are extensive and can provide valuable insights into your business’s financial health. The Profit and Loss statement includes three key components-revenue, expenses, and income. The Balance Sheet shows your assets, liabilities, and equity at a given point in time. For cash flow management, the Statement of Cash Flows proves invaluable.

One often overlooked report is the Accounts Receivable Aging report. This report helps companies analyze their customers’ outstanding invoices and maintain a healthy cash flow.

Mastering these essential QuickBooks features will enable you to maintain accurate financial records and gain valuable insights into your business performance. However, if you find yourself struggling with any aspect of QuickBooks (or if you simply want to optimize your usage), professional assistance can make a significant difference. In the next section, we’ll discuss common QuickBooks mistakes and how to avoid them, ensuring you make the most of this powerful tool.

QuickBooks users often miscategorize transactions, which can distort financial reports. For example, labeling a business meal as office supplies inflates expenses in the wrong category. To prevent this, create clear categorization guidelines and train all users on these standards. QuickBooks’ bank rules feature can automate this process for recurring transactions, which reduces human error.

Many businesses fail to reconcile accounts regularly, leading to financial discrepancies. A study by Wasp Barcode Technologies found that 18% of small businesses face cash flow issues due to poor bookkeeping practices. To address this, establish a reconciliation schedule: weekly for high-volume accounts and monthly for others. QuickBooks’ auto-reconciliation feature can streamline this process and flag discrepancies for review.

Neglecting data backups can have catastrophic consequences. Statistics say that 25% of businesses won’t open again after a disaster. While QuickBooks Online automatically backs up data, Desktop users must take proactive measures. Set up automatic backups to a secure cloud storage service to protect your financial data (even if your local system fails).

Many QuickBooks users miss out on efficiency-boosting features. The time tracking tool can significantly streamline billing for service-based businesses, while the inventory tracking feature can prevent stockouts and overstock situations. Explore these features and integrate them into your workflow to maximize QuickBooks’ potential.

Some businesses attempt to navigate QuickBooks without expert assistance, which can lead to costly mistakes. Professional guidance can help optimize QuickBooks usage and avoid common pitfalls. Clear View Business Solutions specializes in tailoring QuickBooks to meet the unique needs of small businesses in Tucson, offering personalized support to ensure accurate financial management.

QuickBooks bookkeeping basics form the foundation of small business success. Proper setup, feature utilization, and regular maintenance provide valuable insights into business performance. These practices enable informed decision-making, growth opportunity identification, and early issue detection.

Professional guidance can significantly enhance QuickBooks usage. Clear View Business Solutions specializes in optimizing QuickBooks for Tucson small businesses. We tailor the software to specific needs, ensuring full capability leverage while avoiding common mistakes.

Our comprehensive services include QuickBooks training, full-cycle bookkeeping, and tax planning (with expertise in startup financial foundations). Clear View Business Solutions acts as a financial ally committed to your business growth. Mastering QuickBooks bookkeeping basics provides a competitive edge in today’s fast-paced business environment.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.