Inheritance tax planning is a critical aspect of preserving your wealth for future generations. Many people underestimate its impact, potentially leaving their loved ones with a hefty tax bill.

At Clear View Business Solutions, we’ve seen firsthand how proper planning can make a significant difference in protecting your legacy. This guide will explore effective strategies to minimize inheritance tax and ensure your assets are distributed according to your wishes.

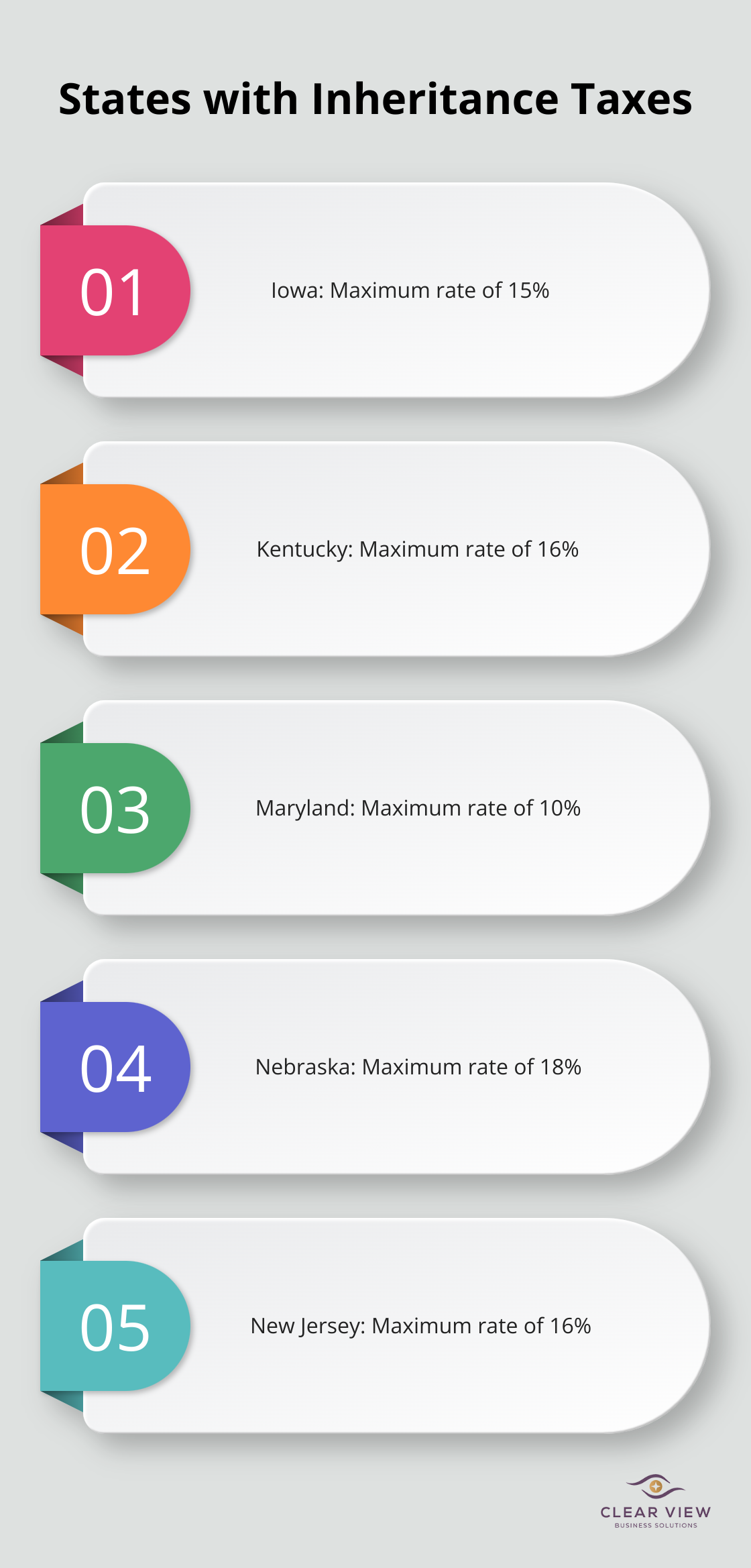

Inheritance tax is a levy potentially paid by the recipient of assets inherited from a deceased individual. It’s a complex topic that often surprises people, potentially leaving their loved ones with unexpected financial burdens. While the United States doesn’t impose a federal inheritance tax, six states levy inheritance taxes. The tax rates in these states can reach up to 16% on amounts exceeding the state threshold (a significant portion of one’s estate).

The liability for inheritance tax typically falls on the person receiving the inheritance. However, the relationship between the deceased and the beneficiary often affects the tax rate. For example, in most states with inheritance taxes, transfers to spouses are exempt. Children and grandchildren may also enjoy lower rates or exemptions in some states.

Inheritance tax rates and thresholds vary significantly by state. For instance:

It’s important to note that these rates and thresholds can change. You should always check the most current information for your specific state, as tax laws are subject to frequent updates.

Understanding inheritance tax is essential for effective estate planning. Without proper planning, a significant portion of your hard-earned assets could end up going to the government instead of your loved ones. This is where strategic financial planning becomes invaluable.

For those living in states with inheritance taxes (or those with beneficiaries in these states), it’s essential to work with experienced financial advisors. Clear View Business Solutions specializes in creating tailored strategies to minimize tax burdens and maximize the legacy you leave behind.

As we move forward, it’s important to consider how you can protect your assets from excessive taxation. The next section will explore various strategies you can employ to minimize inheritance tax and ensure your wealth is passed on according to your wishes.

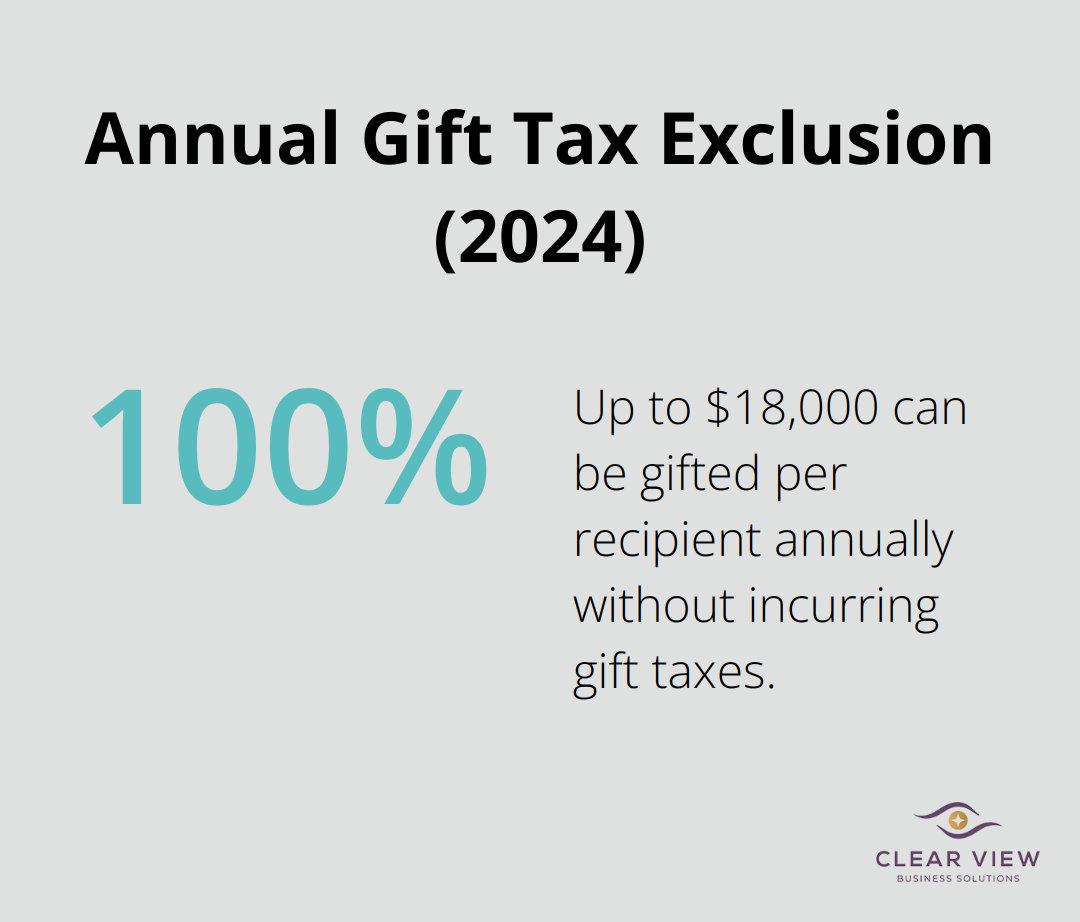

One of the most effective ways to reduce inheritance tax involves gifting assets during your lifetime. The IRS permits untaxed annual gifts up to $18,000 per recipient in 2024. This allows a married couple to gift up to $36,000 to each child or grandchild annually without incurring gift taxes. Over time, this strategy can significantly reduce the size of your taxable estate.

Exercise caution with larger gifts. Amounts that exceed the annual limit may count against your lifetime gift tax exemption. Maintain detailed records of all gifts to ensure compliance with IRS regulations.

Trusts serve as powerful tools in estate planning. They help you maintain control over your assets while potentially reducing inheritance tax. An irrevocable life insurance trust (ILIT) can keep life insurance proceeds out of your taxable estate. This proves particularly beneficial as life insurance benefits typically avoid income tax, maximizing the legacy for your beneficiaries.

A Grantor Retained Annuity Trust (GRAT) offers another option. This trust allows you to transfer appreciating assets to beneficiaries with minimal gift tax consequences. GRATs work especially well when interest rates remain low and asset values are expected to rise.

Investing in tax-exempt assets can effectively minimize inheritance tax. Municipal bonds, for instance, avoid federal taxes (and often state taxes as well). This strategy can particularly benefit high-net-worth individuals in high-tax states.

Try to maximize contributions to tax-advantaged retirement accounts like 401(k)s and IRAs. While these accounts don’t directly reduce inheritance tax, they can help you manage your overall tax liability, potentially leaving more for your heirs.

Charitable donations can decrease the size of your estate, thus reducing the inheritance tax burden on your beneficiaries. Moreover, they allow you to support causes you care about while enjoying tax benefits. Consider establishing a charitable remainder trust, which provides income to you or your beneficiaries for a set period, with the remainder going to charity. This can result in immediate tax deductions and potentially lower estate taxes.

Inheritance tax laws are complex and subject to change. What works for one person may not be the best strategy for another. Work with experienced professionals who can tailor a plan to your specific situation. Clear View Business Solutions specializes in creating comprehensive estate plans that protect your wealth and minimize tax liabilities. Our team stays up-to-date with the latest tax laws to ensure your plan remains effective over time.

As you consider these strategies to minimize inheritance tax, it’s important to understand how professional guidance can further enhance your estate planning efforts. Let’s explore the role of financial advisors and how they can help you navigate this complex landscape.

Financial advisors play a pivotal role in crafting effective inheritance tax strategies. They possess knowledge about current tax laws, exemptions, and potential benefits for your estate. A skilled advisor can help you maximize the annual gift tax exclusion (which allows you to give up to $19,000 per recipient in 2025 without incurring gift taxes).

Financial advisors provide valuable insights into tax-efficient asset structuring. They might recommend a Qualified Personal Residence Trust (QPRT) to remove your home’s value from your taxable estate, potentially saving your heirs thousands in taxes.

Cookie-cutter approaches often fall short in inheritance tax planning. Each individual’s financial situation requires a unique strategy. A thorough understanding of your specific circumstances, goals, and family dynamics allows for the creation of a customized plan that aligns with your wishes while minimizing tax liabilities.

For small business owners, establishing a Family Limited Partnership (FLP) might be beneficial. This structure helps maintain control over business assets while gradually transferring ownership to heirs, potentially reducing the taxable estate.

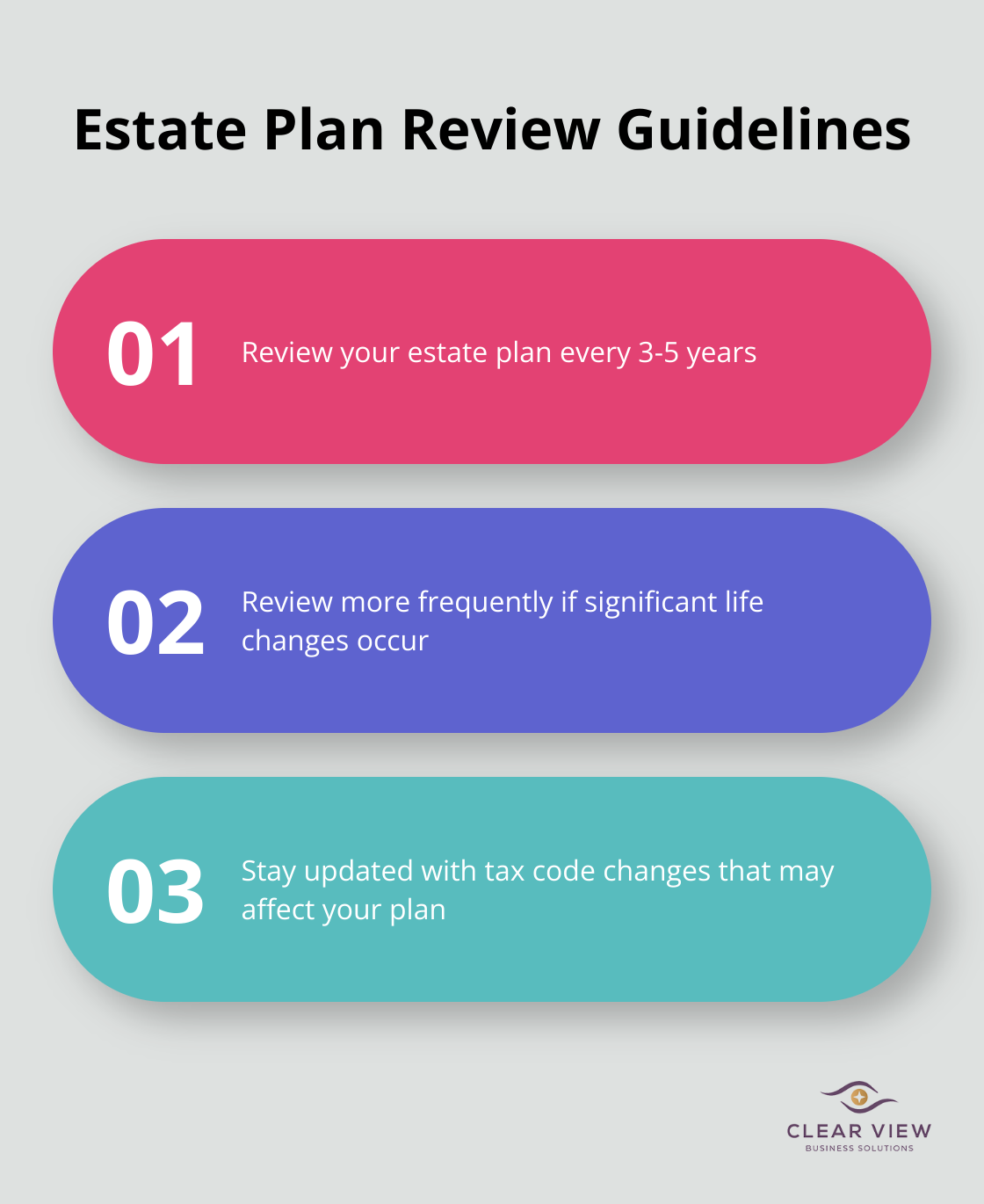

Tax laws change, and your estate plan should adapt accordingly. Regular reviews ensure your plan remains effective and compliant with current regulations. The Tax Cuts and Jobs Act of 2017 significantly changed estate tax exemptions, doubling the amount of assets that are exempt from taxation for the period 2018 to 2025.

We suggest reviewing your estate plan at least every three to five years (or more frequently if significant life changes or tax code updates occur). This proactive approach helps you address potential issues and take advantage of new opportunities as they arise.

Selecting the right financial advisor is critical for effective inheritance tax planning. Look for advisors with specific expertise in estate planning and tax law. They should stay current with the latest regulations and strategies.

Clear communication is essential. Your advisor should explain complex concepts in understandable terms and be responsive to your questions and concerns.

Modern estate planning incorporates advanced technology tools. These tools can help track assets, model different scenarios, and keep your plan updated. Some advisors use software that allows real-time collaboration with clients, ensuring your plan remains aligned with your goals as circumstances change.

It’s important to note that while estate planning fees may incur costs, they can potentially offer tax benefits and help maximize your overall estate value.

Inheritance tax planning protects your wealth for future generations. Strategic gifting, trusts, tax-efficient investments, and charitable giving reduce the tax burden on your beneficiaries. These strategies, tailored to your financial situation, ensure your assets are distributed according to your wishes.

Proactive planning provides flexibility to make informed decisions and adjust your strategy as needed. This approach allows you to take full advantage of current tax laws and exemptions (potentially saving your heirs substantial sums). Clear View Business Solutions specializes in creating comprehensive financial strategies that minimize tax liabilities and maximize estate value.

Inheritance tax planning requires ongoing attention and expert guidance. Regular reviews and updates to your plan account for changes in tax laws, personal circumstances, and financial goals. Contact a qualified financial advisor today to develop a strategy tailored to your unique needs and protect your legacy for generations to come.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there.

Northwest Location:

7530 N. La Cholla Blvd., Tucson, AZ 85741

Central Location:

2929 N Campbell Avenue, Tucson, AZ 85719

© 2025 Clear View Business Solutions. All Rights Reserved.

At Clear View Business Solutions, we know you want your business to prosper without having to worry about whether you are paying more in taxes than you should or whether your business is set up correctly. The problem is it's hard to find a trusted advisor who can translate financial jargon to layman's terms and who can actually help you plan for better results.

We believe it doesn't have to be this way! No business owner should settle for working with a CPA firm that falls short of understanding what you want to achieve and how to help you get there. With over 20 years of experience serving hundreds of business owners like you, our team of experts combines financial expertise and proactive communication with our drive to help each client achieve results and have fun along the way.

Here's how we do it:

Discover: We start with a consultation to understand your specific goals, what's holding you back, and what success looks like for you.

Strategize & Optimize: Together, we design a customized strategy that empowers you to progress toward your goals, and we optimize our communication as partners.

Thrive: You enjoy a clear view of your business and your financial prosperity.

Schedule a consultation today, and take the first step toward being able to focus on your core business again without wondering if your numbers are right- or what they mean to your business.

In the meantime, download, "The Business Owner's Essential Guide to Tax Deductions" and make sure you aren't leaving money on the table.